Table of Contents

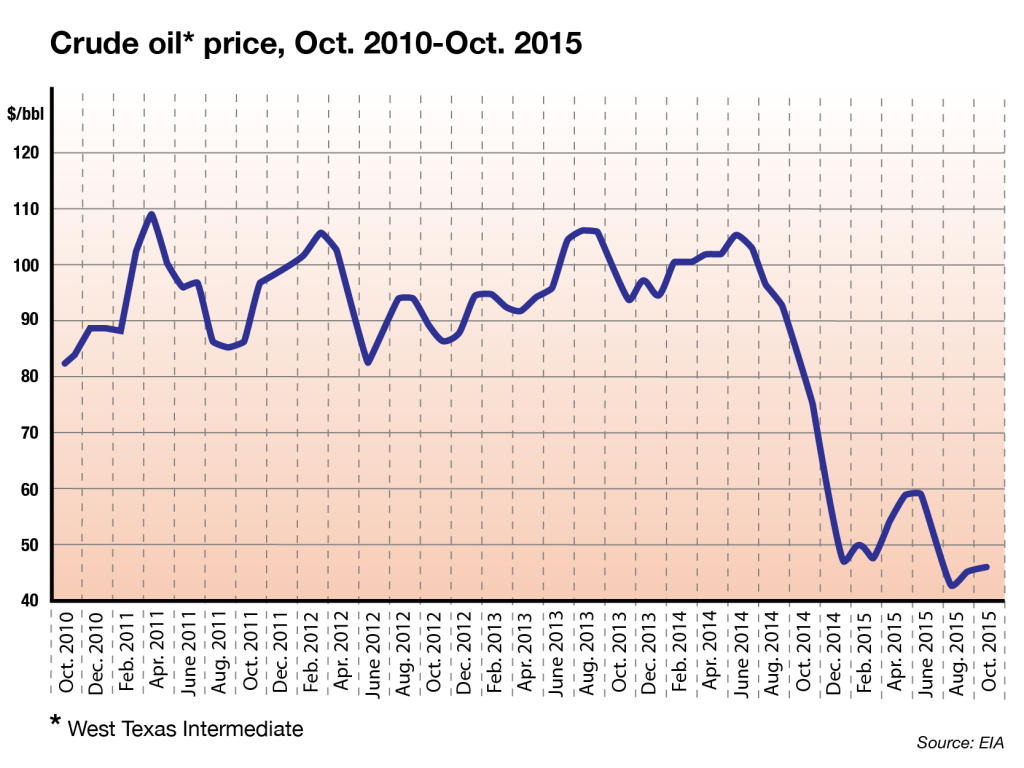

- Crude oil prices continue to rise

- Oil Price Charts - Business Insider

- Oil Price Index Live Chart Today (Sep 14) - oftrb.com

- Historical Crude Oil Prices – Energy History

- Oil Prices Forecast for 2023 and Beyond: Will Brent Crude Oil Go Up?

- لماذا ترتفع أسعار النفط إلى مستويات قياسية ؟ – وطن24

- Crude oil prices today: WTI, Brent rise ahead of inflation data

- Oil Prices: Oil Prices Drop Today

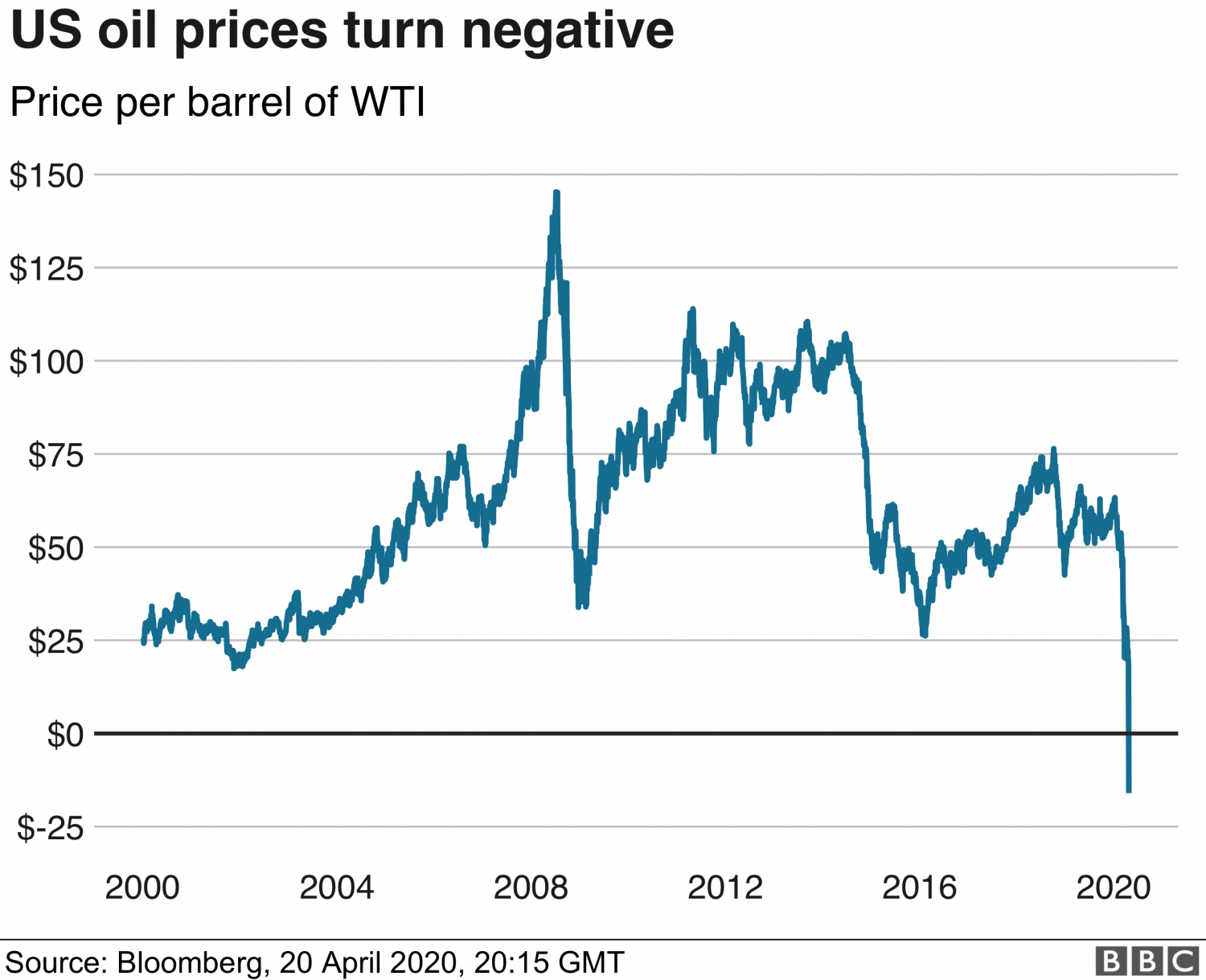

- Negative US Oil Prices Bloomberg – 20 April 2020 | JC History Tuition

- Crude Oil Price | Crude Oil Price Chart | Trading Strategy

Current Crude Oil Prices

Market Trends and Analysis

Projections and Outlook

Looking ahead, the crude oil market is expected to continue to be influenced by a range of factors, including: OPEC Production Levels: The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in determining global oil supplies. Changes in OPEC production levels can have a major impact on crude oil prices. Global Demand: Growing demand from emerging economies, particularly in Asia, is expected to drive up oil demand and prices in the coming years. Renewable Energy: The increasing adoption of renewable energy sources, such as solar and wind power, may lead to a decline in oil demand and prices in the long term. In conclusion, the current crude oil prices are influenced by a complex array of factors, including supply and demand, geopolitical tensions, and global economic trends. As the energy market continues to evolve, it is essential to stay up-to-date with the latest news and analysis from reputable sources like OilPrice.com. By understanding the market trends and projections, investors, policymakers, and consumers can make informed decisions and navigate the complexities of the crude oil market.For the latest updates on crude oil prices, market trends, and analysis, visit OilPrice.com today.

Note: The current prices and market trends are subject to change and may not reflect the actual prices at the time of reading. It is essential to check the latest updates and analysis from reputable sources for the most accurate information.