Table of Contents

- The IRS has announced 3 key changes to 401(k)s for 2025 — here's how to ...

- Retirement plans are changing in 2025: What to know - ABC News

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Retirement plans are changing in 2025: What to know - ABC News

- It's Official: 401(k) Contribution Limits for 2025 Are Here

- Older workers can contribute more to their 401(k)s in 2025: Here's why

- Here’s how much 401(k) contribution limits are likely to rise next year ...

- Notable 401(k) and IRA plan changes for 2025 | Accounting Today

- Irs 401k Limits 2025 Married Filing Jointly - Betsey Vinnie

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

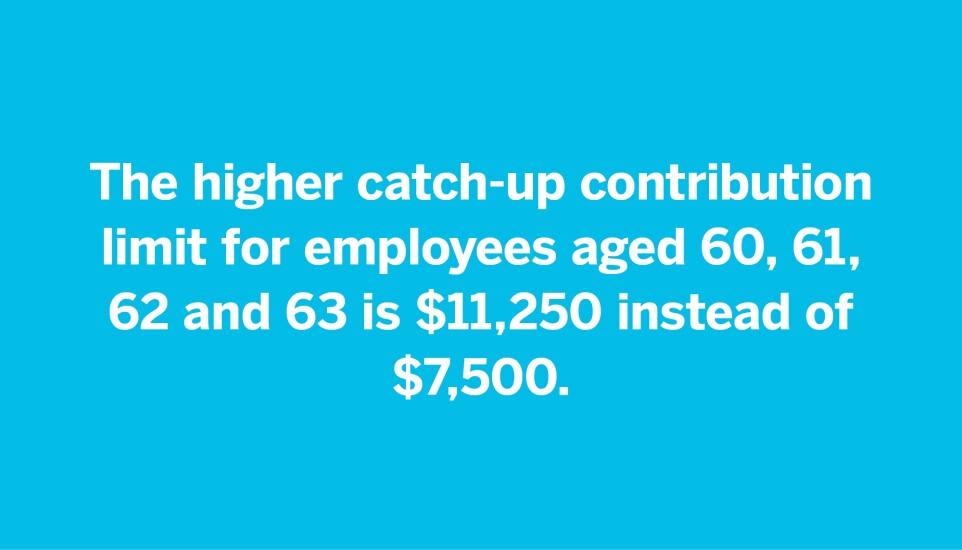

401(k), 403(b), and Thrift Savings Plan Limits

IRA Contribution Limits

Defined Benefit Plan Limits

For defined benefit plans, the annual benefit limit has been increased to $265,000 in 2025. This limit applies to the maximum amount of benefits that can be paid from a defined benefit plan, providing a higher ceiling for individuals with these types of plans.

SEP-IRA and Solo 401(k) Limits

Self-employed individuals and small business owners can take advantage of higher contribution limits for SEP-IRAs and solo 401(k) plans in 2025. The annual limit for SEP-IRAs has been increased to $61,000, while the solo 401(k) limit has been raised to $57,000, with an additional $7,500 catch-up contribution allowed for those aged 50 and older.